MoneyTime is an online financial literacy program for students ages 10 through 14. While that's the intended audience, I would also use it with high school students, even though it might sometimes seem simplistic and makes mention of students’ future in high school. The reason I say this is that the program covers many topics that are years down the road for those below age 15, such as jobs, résumés, taking out loans, and buying property.

The program is available via monthly or yearly subscriptions, with customized versions for the United States, Australia, New Zealand, and South Africa.

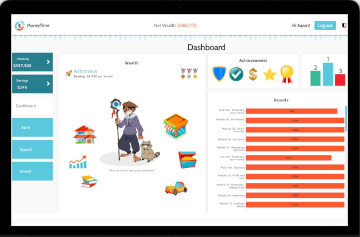

Students earn virtual money by completing 30 modules and answering quiz and test questions. Titles of the 30 modules (listed under the program’s topics) are:

Earning, Saving Interest

Earning

Saving

Interest

Employment

Career choice

CV (résumé)

Job application

Pay and tax

Managing Your Money

Smart Spending

Budgeting

Banking

Paying

Borrowing Money

Borrowing

Loans

Loan Repayments

Property

Rent or buy

Mortgages

Buying Property

Rental Property

Investing

Fixed Deposits

Property Investment

Shares

Collectibles

Business

Business Basics

Marketing

Promotion, Selling, Price

Profit and Loss

Protecting Your Money

Warranties and cash

Insurance

Online Security

Net Wealth

An additional 14 modules mirror topics students have just completed by having them gather information from an adult through an interview or other interaction. For instance, the fifth and sixth modules ask students questions, then create a résumé and a cover letter (both emailed to the student as PDFs). These two modules and the 12 others are followed by optional parent modules where students ask questions of an adult and create a resume, a cover letter, a budget, etc., based on the adult's more extensive work and life experience. The comparison gives students a more accurate idea of what their financial and job documents might look like when they are older. While these are not required, they provide great opportunities for parents to discuss the topics with their children.

The program is up to date, as evidenced by the inclusion of topics such as mobile wallets and the rarity of check writing.

MoneyTime modules go beyond the basics with each topic, but not too much for teens. For instance, they learn about savings accounts, compound interest, and the availability in many states of savings accounts designed for young people. They also use the online calculator to see the effects of compound interest. On a more sophisticated topic, whether to rent or buy property, it teaches that the cost of homes varies by area. It tells students that before they think about buying a home, they need to find out where they will be working since the job they want might not be available in the area they would like to live. It also walks students through various budget calculations to see when renting or buying makes more sense. It might provide a bit more information than 10- or 11-year-olds need, but it's perfect for those just a little older.

Students take a pretest and posttest for each topic plus multiple-choice quizzes at the end of each module. The goal is to build virtual wealth in the program, and students earn virtual money by completing the 30 modules and answering quiz and test questions correctly. Students also get to select an avatar after completing the first quiz.

Students can choose from several ways to “spend” their earnings within the program. They can spend what they’ve earned customizing their avatar, but, more importantly, money can be “invested” through options for education, purchasing CDs or stocks, and buying property. Students can also donate money and earn “generosity medals.”

The program assumes that higher levels of education correlate with higher earnings, which is no longer a safe assumption. Nevertheless, if a student invests more in education, this is reflected in higher earnings within the program.

Lesson Format

Instruction is presented in small increments via text on the screen, cartoon characters with conversation bubbles, and occasional illustrations. No earphones are required past the introductory video. Many screens within the instructional portion require students to type in answers, select from true/false answers, drag the correct words into sentences, or solve a math problem.

Some math problems require multiplication and division within word problems, such as asking how much you earn if you work for three and a half hours at $8 an hour or how many weeks it will take to earn enough money to pay for a desired item. An onscreen calculator is provided, and cartoon characters sometimes tell students which math process they should use to arrive at answers.

Students supply some individual responses, such as naming two jobs they would like to do now and an item they want to save money to purchase. Occasional questions appear later that relate specifically to those responses.

The multiple-choice quiz questions often have only one reasonable answer, but there are usually two more difficult questions in each quiz to challenge more competent students. Since they need only seven of the ten answers to be correct to pass, students should have little trouble passing each quiz.

The program estimates it takes 20 minutes to complete each module. Students cannot skip ahead but must complete the modules in order.

Parents have a separate login from which they can track student progress and print out or export results if needed.

Summary

MoneyTime is easy enough for ten-year-olds to use, but the content seems best for teens who will soon be applying for jobs, creating their own budget, thinking about purchasing a car, and making other adult financial decisions. I think it's ideal for ages 12 to 16.